(http://hallingblog.com/2009/05/26/innovation-regulatory-road-kill/)

The 90’s brought us companies such as Amazon.com, eBay, Netscape, Broadcom, and AOL to name a few. We discovered web browsers, PDAs, universal email, voice over IP, DSL, broadband cable, cable telephony, Wi-Fi, and TiVo among others. The 80’s brought us companies such as Dell, Compaq, Cisco, Microsoft, Qualcomm, Adobe Systems, and Genentech. We discovered personal computers, cellular telephones, spreadsheets, and genetic engineering. This decade we have Crocs and the iPod. Where has American innovation gone?

John Kao, an expert on innovation from Harvard, claims the U.S. is experiencing a brain drain as foreign scientists and engineers return to their native countries for better opportunities. Even more alarmingly, other countries are luring away U.S. born scientists and engineers. Much of our venture capital industry is investing their resources outside the U.S. Those venture capital funds not invested overseas are often part of the walking dead, no longer actively investing.

Why should we worry whether the U.S. is no longer the innovation leader of the World? Without innovation our standard of living is stagnant or declining. So why have we stopped innovating? Let’s look for the changes since 2000, that would effect the ability of a Qualcomm, CISCO, eBay or Amazon.com to fulfill its potential today. There are three such major changes since 2000. Sarbanes Oxley makes it much more difficult to go public today. Changes to patent law make it more difficult to secure intellectual property and easier to steal innovations. Finally, changes to stock option accounting rules make it difficult lure talent to start-up companies.

When Sarbanes Oxley was passed the SEC (Securities and Exchange Commission) estimated the cost of compliance would be $91,000.00 per year for each public company. The most recent estimates for the cost of compliance are between $4.0 million and $5.0 million per year for publicly traded companies. The United States has over 18,000 public companies, which means the U.S. spends around $80 Billion a year to comply with Sarbanes Oxley.

Sarbanes Oxley was passed in 2002 in reaction to the corporate and accounting scandals including those affecting Enron, Tyco International, Adelphia, and WorldCom. The legislation set new or enhanced standards for all U.S. public company boards, management, and public accounting firms. The act contains 11 titles, or sections, ranging from additional corporate board responsibilities to criminal penalties, and requires the Securities and Exchange Commission (SEC) to implement rulings on requirements to comply with the new law.

Is the cost of this law worth its incredible price? Has Sarbanes Oxley achieved its goal of protecting investors from fraud? Sarbanes Oxley has cost the U.S. economy at least $400 billion since it passage. The stock market has been flat or declining since its passage. As a result, it is hard to argue that this legislation increased shareholder value. The banking scandals 2008 & 2009 and the Bernie Madoff fiasco make it impossible to suggest that Sarbanes Oxley has protected investors from fraud.

Sources report that 100 to 200 publicly owned companies per year, including big names such as Dunkin’ Donuts and Neiman Marcus, have chosen to buy out their stockholders and revert to private ownership. Many U.S. private firms are putting off initial public offerings, and more foreign companies are choosing to list on the Tokyo, London or other foreign exchanges rather than on the U.S. stock exchanges.

In addition, to these problems, Sarbanes Oxley has essentially killed off the public market as an exit strategy for technology start-up companies, thereby reducing investment in innovative start-up companies. In the second quarter of 2008, there were no public offerings of Silicon Valley venture capital-backed companies, a phenomenon not seen since 1978. At $4-5 million per year for a company to go public and comply with Sarbanes Oxley, it must have earnings of about $100 million and sales of around $1 billion. Given these astronomical hurdles to an IPO (Initial Public Offer), it is not surprising that start-up companies no longer consider an IPO a realistic exit strategy. Repealing Sarbanes Oxley is essential unless we want to see Silicon Valley’s status as a hotbed of innovation erode and see the future invented outside of the United States.

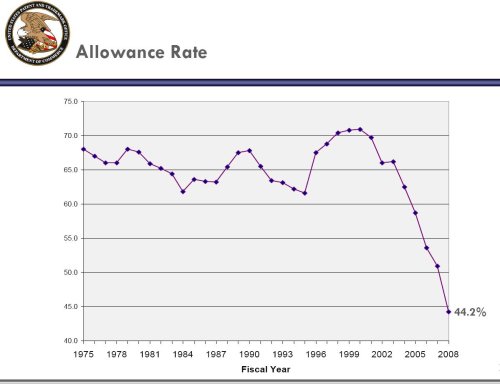

Changes to the patent laws in the last decade favor technology appropriators over technology creators. The Supreme Court’s eBay ruling denied inventors’ ability to enforce their basic right to exclude others from using their invention. The Supreme Court’s KSR decision changed the standard for what is patentable from an objective standard to a subjective standard. Finally, the U.S. Patent and Trademark Office (USPTO) independently changed the internal standard for what inventions receive patents. This change has resulted in the allowance rate falling from around 70% in 2000 down to 45% in 2008. Harmonization of our patent laws with the rest of the world has broken the social contract between inventors and society.

The Intellectual Property and Communication Omnibus Reform Act of 1999 requires publication of US patent applications 18 months from the filing date. This Act is part of an effort to harmonize U.S. patent laws with the rest of the world. Patents are commonly considered a deal between the inventor and society. The inventor receives a limited term right to exclude others from using their invention and the quid pro quo is that the inventor discloses how to practice their invention. The publication rule is a clear violation of this social contract between the inventor and society. Under the publication rule, society gets the advantage of the disclosure of the invention even if the inventor never receives any property rights in his invention. Before the publication rule, if an inventor felt that the scope of the claims to his invention were too narrow or not allowable, he could withdraw his application and keep his invention a trade secret. Narrow claims are easy for a competitor to design around providing little protection in exchange for the disclosure of the invention. In other words if the inventor did not like the deal he was offered from the Patent Office he could reject it and keep his invention a secret. Even for inventions that can be reverse engineered once the invention is marketed, this is a better deal than the publication rule. Under the publication rule, it is easy for competitors to find the inventor’s idea on the World Wide Web and copy the invention. Without publication, a competitor has to spend the time and money to reverse engineer an invention.

In 2006 the US Supreme Court decided eBay Inc v. MercExchange, L.L.C., 547 U.S. 388 (2006) holding that a permanent injunction should not automatically issue as part of a judgment of infringement. A patent is a legal right to exclude, 35 USC 154, others from making, using, selling (offering for sale), or importing the invention. It is a little known fact that a patent does not give the holder the right to use, make, sell (offer for sale) or import the invention. The Supreme Court’s eBay decision denies a patent holder’s right to exclude others and substitutes monetary damages even if the patent holder prefers to enforce their right to exclude.

In KSR International v. Teleflex, 550 U.S. 398 (2007) the Supreme Court made it easier to find a patent invalid, and harder to obtain a patent by changing the standard for obviousness. In order to obtain a patent, the invention has to useful, novel, and non-obvious. This case overturned 20 years of jurisprudence associated with an objective test of obviousness. The Supreme Court substituted a flexible subject test for obviousness. This more flexible approach increases the uncertainty that an inventor will receive a patent and increases the risk that their patent is found invalid if they have to enforce their patent against an infringer. It also increased the costs associated with obtaining a patent and in enforcing a patent.

Not to be outdone, the Patent and Trademark Office launched their own assault on inventors. The allowance rate for patents has dropped from around 70% in 2000 down to 45% in 2008. The allowance rate had hovered around 62%-72% for several decades and then started a precipitous drop around 2003.

These changes to our patent systems have been nothing less than a full-out assault on the rights of innovators.

In 2005 FASB required companies to start expensing stock options. Start-up companies used stock options as a major tool in luring human talent from secure positions. Requiring the expensing of stock options places an enormous burden on start-ups. This burden has resulted in start-ups foregoing their use. There is no economic justification for expensing stock options, since changing the number of shares for a company does not change its income statement. However, the burden of this regulation has taken this important financial tool away from start-up companies and hurt innovation in the U.S.

U.S. innovation is stagnant because of the regulatory burden we have placed on high technology start-up companies. Both the empirical evidence and the logical case for Sarbanes Oxley, changes in the patent laws and the required expensing of stock options fail. Repealing these regulatory burdens on innovators will jump-start the U.S. economy.

Thursday, September 03, 2009

Innovation – Regulatory Road Kill?

Labels:

Economics,

Government Control,

Regulations

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment